|

|

A demographic shift looms: Some 76 million baby boomers will soon reach retirement age, crushing the health-care system and the social safety net with their massive numbers. But we have a greater concern: Who’s going to buy all their cars?

“I think that boomers are taking a more practical approach to baggage. We want to lighten our loads sooner,” says Charlie Kuhn, a 52-year-old collector from the Chicago area. “Guys not much older than me are selling because their kids aren’t interested. I’m already thinking about downsizing.”

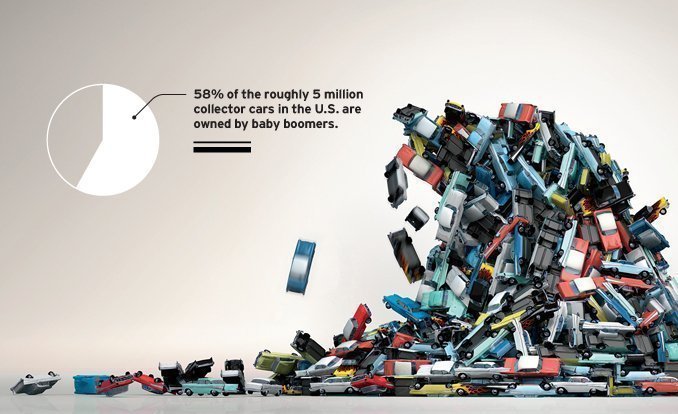

The best estimates we have at the Hagerty Group, which sells classic-car insurance, peg the number of collector cars in the U.S. at roughly 5 million, of which 58 percent are owned by baby boomers, or those born from 1946 through 1964. Our data says that the median age of collector-car owners is 56 years. The oldest boomers are approaching 70, and their interest in the hobby is starting to wane. We won’t see a generation of similar size until the so-called millennials hit their peak earning years in a few decades. It’s questionable whether they will care about the cars of their grandfathers and great-grandfathers—or any cars, for that matter.

|

|

Confusing the issue further is the fact that the collector-car market is surging right now. Last July, a 1954 Mercedes W196 racer crossed the block for $29.6 million, smashing the old record for a price paid at auction by more than $13 million. Then in August, a ’67 Ferrari 275 GTB/4-S NART Spyder took in $27.5 million, the highest price ever for a road car. However, for all those blue-blood auction results, and some hot niches within the hobby as a whole, there are far more examples of mundane Detroit iron sitting in the garages of graybeards. A vast majority of collector cars in the U.S. are, predictably, American—some 80 percent, according to Hagerty data. It’s this backbone of the hobby that is likely in trouble.

We at Hagerty maintain a stock-market-style index for various sectors of the classic-car market. The one for 1950s American classics is precisely where it was in January 2010, indicating that demand for formerly appreciating blue chippers, such as the 1955–57 Chevrolet Bel Air, has likely peaked [see above]. Even the ’55–57 Thunderbird two-seaters—once considered the bluest of blue-chips—are struggling.

“They’re astonishingly cheap now,” says Bob Lichty, a Canton, Ohio, dealer who’s been part of the classic-car industry for about 40 years. “The guys who wanted them new are starting to age out of the hobby. A ’60s ‘Bullet Bird’ convertible is easier to move now.”

|

|

|

Clockwise from top: 1967 Ferrari 275 GTB/4-S NART Spyder, Mercedes-Benz W196 Grand-Prix race car, 1957 Ford Thunderbird convertible |

As we speculate about how the collector-car market might change in the next two decades, it’s helpful to consider some history. Car collecting traces its roots to the Great Depression, which extinguished grand American marques such as Auburn, Cord, and Duesenberg and ended the era of bespoke coachbuilding. Having saved western civilization during World War II, members of the Greatest Generation turned to saving America’s prewar automotive heritage. They realized with startling prescience that the “classic era,” as it became known, represented bygone automotive craftsmanship. They collected, preserved, and restored these cars and started clubs such as the Classic Car Club of America and the Antique Automobile Club of America. On the whole, the World War II generation was a good steward of the hobby it created, collecting the aspirational cars of its youth in a pattern that collectors have followed ever since.

And so it went until the early 1970s, when the collector-car auction business began. Prices for prewar cars rose steadily until the late 1990s when they hit the wall, in part because of oversupply. As the Greatest Generation aged, they scaled back by selling off collections. And as more collectors began to die, the market for prewar cars dried up. The stagnant prices of ’50s American cars hint that history may be repeating itself.

View Photos

View Photos

Leave a Reply